Mangroves to Mansions, Expert land surveying, all over Florida.

Mortgage Survey

Getting a loan? Your lender may require a mortgage survey to verify the property meets their requirements.

Smooth Sailing to Homeownership with a Fast, Mortgage Survey

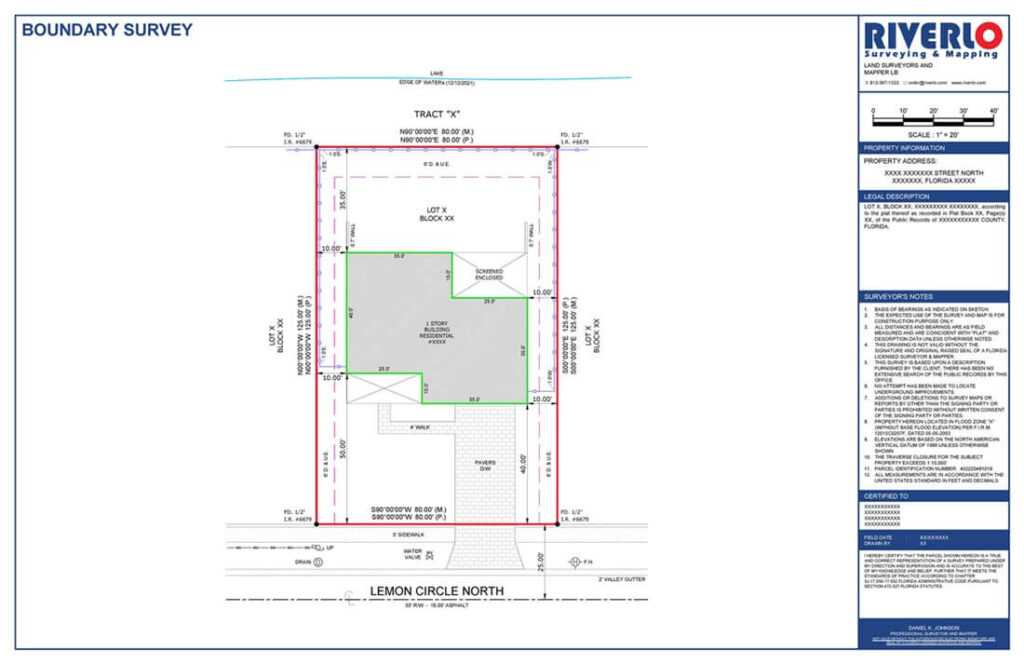

If you’re buying a home in Florida and need a mortgage, you’ll likely need a mortgage survey. This is basically an inspection of the property to make sure everything is in order. Riverlo Surveyors can help with that! We’ll check the boundaries of the parcel to avoid any property disputes and Make sure there aren’t any unexpected buildings or structures on the property.

In addition to avoiding property disputes and surprises, a mortgage survey can also help you identify any potential encroachments on the property. An encroachment is when a structure or object from a neighboring property extends onto your land. By knowing about any encroachments beforehand, you can avoid problems down the road, such as difficulty selling your property or having to remove unexpected structures.

Who can benefit?

- Homebuyers needing a mortgage.

- Realtors, lenders, and title companies working on real estate deals.

Quick Quote

Secure financing with a Professional land survey, fast and easy.

Fulfilling Appraisal Requirements with a Land Survey

How about this? Imagine you’re buying a house in Florida and using a loan to pay for it. Banks want to make sure the land is good before lending money, so they ask for a mortgage survey.

So, whether you’re the buyer needing a mortgage survey, a realtor helping a client, a lender making sure everything’s in order, or a title company finalizing the deal, Riverlo Surveyors can be your one-stop shop for smooth sailing through the mortgage survey process in Florida. Give us a call and let us take care of the surveying work for you!

Riverlo Surveyors

We’re a Florida land surveying company that’s been around the block (or should we say, property line?). We know the importance of knowing exactly where your land starts and ends, because in Florida, paradise comes with property lines! Our team of professional surveyors uses top-notch equipment to survey your parcel, so you can build your fence, plan that perfect pool or build a house.